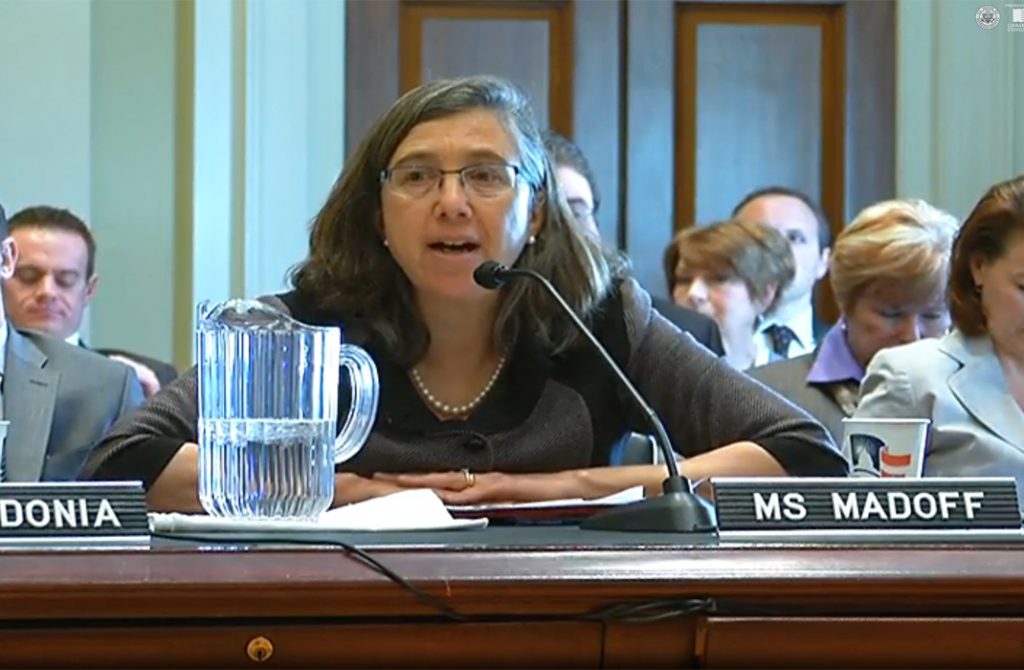

Boston College Law Professor Ray Madoff testified in Washington, D.C., March 18 before the Congressional Ways and Means Committee on the issue of repealing the nearly century-old Estate Tax. Although Congress is seriously considering the repeal, according to Madoff it would be a mistake, with far-reaching societal costs and negative repercussions.

Professor Ray Madoff testifies in the video below at 10:52, 25:05 and 38:56

Transcript of Madoff Testimony

“We should at least maintain the existing estate tax – fairness dictates it,” says Madoff, one of the nation’s leading experts on estate taxes, inheritance laws, tax policy and wealth inequality, and estate planning. “The only taxes that are imposed on inherited wealth are estate taxes and if we fail to have estate taxes, then we’re going to have even greater concentration of wealth among the wealthiest Americans.”

While today’s hearing focused on the problems farms and small businesses are having with the Estate Tax, Madoff says highlighting those two groups is just a decoy.

“More than 90% of assets passing at death are assets others than small business interests, and we should not be giving those assets a free ride based on the potential problem with farms and small businesses,” says Madoff, lead author of Practical Guide to Estate Planning(CCH). “If there is a problem with family farms and businesses, we can carve out an exception. That’s not what the estate tax is about. The estate tax is about addressing matters of wealth and equality and you have to realize that our income tax system gives a complete free ride to inherited wealth.”

Madoff points out that under the existing income tax system, someone who inherits $100 million dollars is treated identically as a person who inherits $0.

“Both have zero tax liability.”

The richest half-percent of Americans control almost a quarter of the nation’s wealth, Madoff says, the same amount of wealth controlled by 90% of the population, a concentration of wealth that will continue to grow if taxes on estates are repealed.

“The Estate Tax doesn’t come close to leveling the playing field, but I think what it does is avoids having a complete giveaway that you would otherwise have because there’s a complete tax exemption on inheritances under the current income tax system,” says Madoff. “We shouldn’t repeal the Estate Tax without appreciating the costs that are going to be imposed.”

Professor Ray Madoff’s areas of expertise include will contests, philanthropy, charitable deduction, estate taxes, inheritance laws, tax policy and wealth inequality, estate planning, rights of the dead, along with rights of privacy and publicity. A regular commentator on a number of these topics, Professor Madoff has appeared on national radio shows (On Point, Talk of the Nation, All Things Considered, Here and Now, and Marketplace). She has been quoted by national entities like The New York Times and Wall Street Journal, while publishing numerous Op-Eds in the New York Times, Washington Post, Los Angeles Times, Bloomberg Views, and the Boston Globe. She’s the author of Immortality and the Law: the Rising Power of the American Dead, which looks at how American law treats the interests of the dead and what this tells us about our values for the living. Professor Madoff was also featured in the Chronicle of Higher Education: “5 Minutes With: A Law Professor on the Property Rights of the Dead.” She is also the lead author of Practical Guide to Estate Planning (CCH), and has written in a wide variety of areas involving property and death.

–Content provided by Boston College’s Office of Public Affairs