We were on break between hours of my Supreme Court seminar when my phone buzzed with an alert. “There’s been another school shooting,” I announced to the students lingering around. “In Florida.” A collective moan. A few days before, I had received a similar alert while teaching constitutional law. That shooting was in Kentucky, down the highway from my hometown. News reports featured a video of my cousin running to the school to ensure her kids were safe. (They were.) It brought back memories of the day we heard the grotesque news of the children gunned down in Newtown, Connecticut. I made a special trip to pick up my son from high school that afternoon, not because I thought he was at particular risk. I just needed to reassure myself of his existence, of his safety.

After every shooting, our attention turns toward Congress. Ban assault weapons. Expand background checks. Require mental health screenings of gun purchasers. There is no shortage of good legislative ideas, only political will.

Maybe our mistake is to depend on Congress.

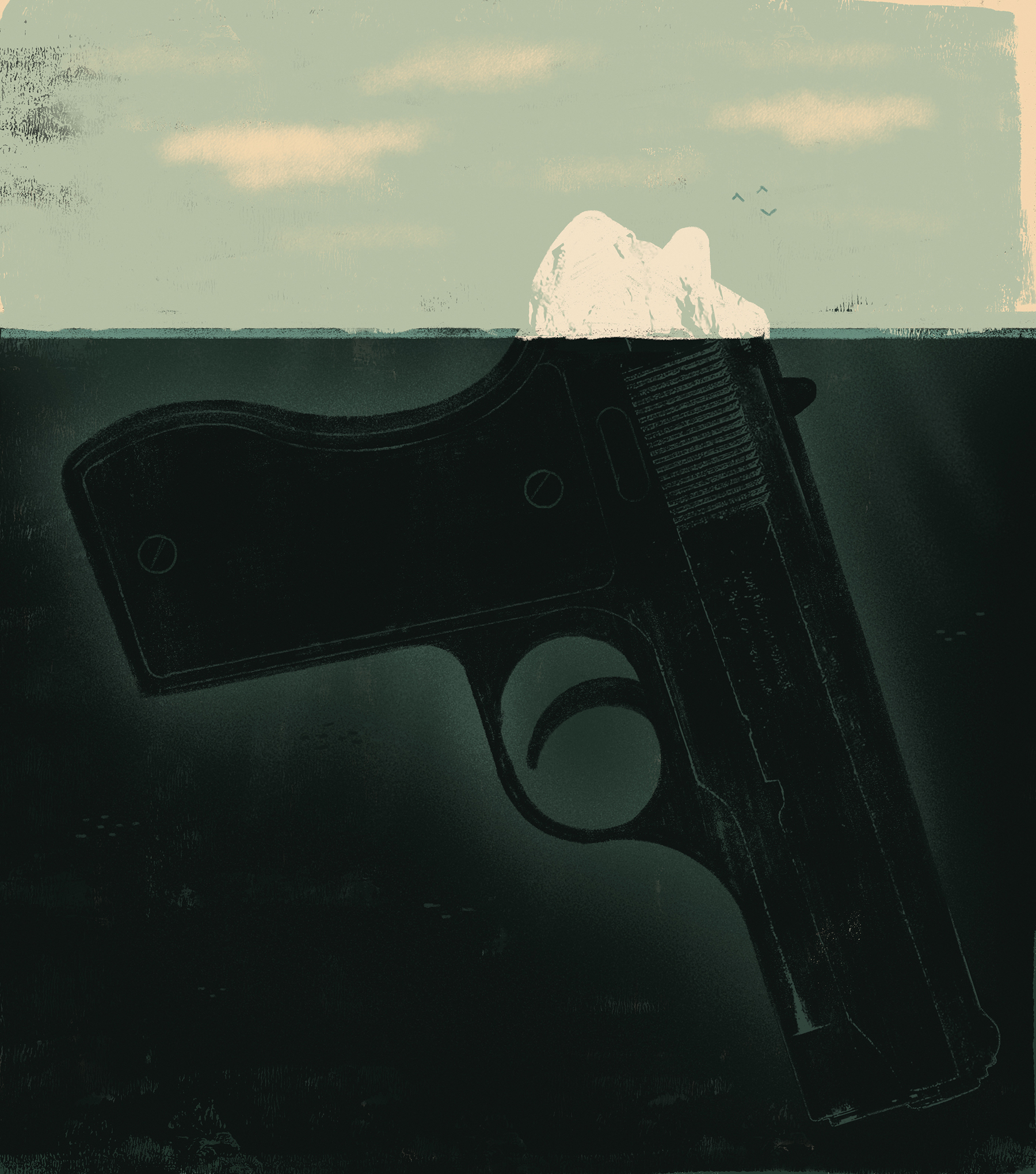

Guns are extremely lucrative. The gun industry produced over $50 billion of economic impact nationwide in 2017, and the industry annually produces over 9 million firearms. The wealth created flows into the coffers of not only the manufacturers, but also retailers such as Walmart and Dick’s Sporting Goods. There are also companies who attach themselves onto the attractiveness of guns—whether it be Amazon’s video service that streams the NRA channel, or the companies from airlines to credit cards offering perks to NRA members.

And I benefit, too. My 401(k) is largely parked in index funds, and those funds invest in companies that benefit one way or the other from the gun trade. I am not alone. Most ironically, perhaps, teachers’ pensions (like most public employees’ pensions) are invested in guns to the tune of billions of dollars. Teachers at Parkland were murdered by a man wielding an AR-15, which is produced by Outdoor Brands Corp.—a company in which Florida teachers’ pension funds invests.

But the economic heft of the gun industry means that we may have more leverage as consumers and investors in the marketplace than as voters at the ballot box. For example, the California State Teachers’ Retirement System is the world’s largest educator pension fund, with over $200 billion held in trust for teachers. After Newtown, it divested from companies manufacturing assault weapons. The guns were dangerous to their teachers; the latent risks of being in that market was dangerous to the fund. After Parkland, the world’s largest asset manager, Blackrock, Inc., announced it would engage with gun manufacturers to pressure them to respond to the reputational and legal risks of producing particularly lethal weapons for the civilian market. Meanwhile, companies aligning themselves with the NRA are facing robust and increasing consumer pressure. More than a dozen companies—including Delta, Avis, and MetLife—recognized the significant risks of aligning with the NRA and ended marketing partnerships with the group.

The risks of firearms to our safety are obvious. The risks of the gun industry to our portfolios are less so, but may give us another avenue to address this increasingly urgent national problem.